Volatility and market fluctuations are inevitable and as the last three years have shown, unpredictable market shocks will always jump out.

Who was expecting, Brexit, Covid or a war in Ukraine?

What we can do is prepare as best we can to mitigate the impact of these unexpected turns in the market.

Maintaining a long-term approach to investing is crucial and avoiding the temptation to time the market should be key to your investment approach.

Alongside this you should seriously consider the diversification of your portfolio.

Diversification is simply the practice of spreading your investments around so that your exposure to any one type of asset is limited, and is designed to help reduce the volatility of your portfolio over time.

This strategy has many different ways of combining assets, but at its root is the simple idea of spreading your portfolio across several asset classes.

A well-diversified portfolio will have funds invested across a variety of different asset classes, such as cash, equity, bonds, commodities, and property.

Asset classes can behave very differently to one another under different market and economic conditions. This means that if one asset class suffers a negative effect, the rest of your portfolio should be insulated to a greater or lesser extent. By adopting a diverse strategy, you can ensure that your portfolio has a better chance of meeting your long-term financial objectives.

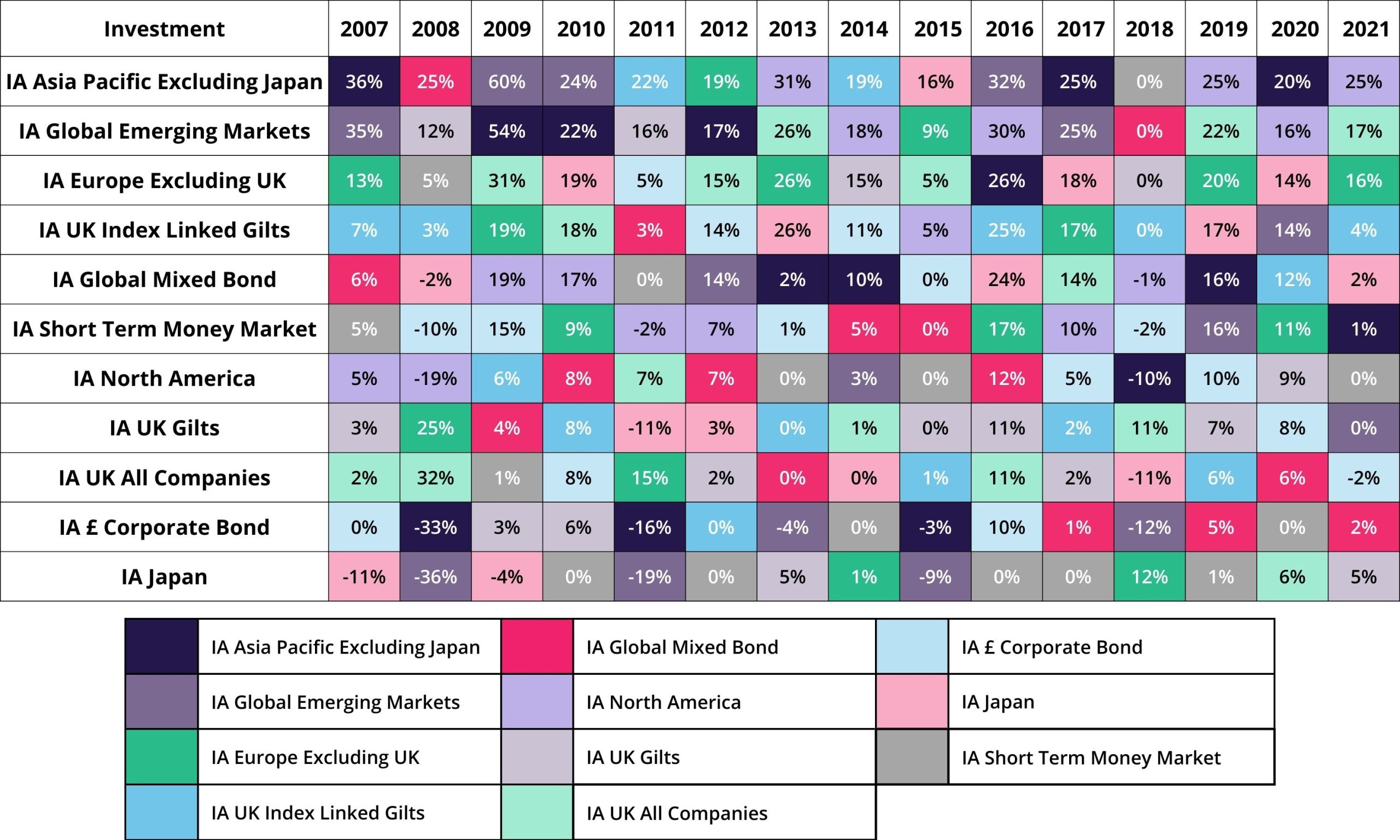

This chart shows a wide variety of major asset classes’ % returns over 15 years and is an excellent illustration of why diversification is crucial.

Individual asset classes behave differently to each other in any given year, with those relationships also shifting from year to year.

Having an appropriate spread of investments across asset classes within portfolios is important to ensure diversification, and a more consistent risk/return profile.

If you’re looking to build a well-diversified portfolio or aiming to expand upon a few investments that you’ve already made, it’s important to focus on diversifying your interests so that you can create the right balance and reduce the level of risk.

A Fairstone adviser can help you find the right balance.

| Match me to an adviser | Subscribe to receive updates |