Planning & protection

These global events have proved to be exceptionally turbulent and have demonstrated what it means to expect the unexpected. As a result timing the market is extremely difficult to do well and should be avoided, particularly by long-term investors.

While we will not always be impacted as much by fluctuations in the market that we have seen over the past two years, there will always be market cycles.

Previous years have seen the likes of Brexit, the global financial crisis and the dot com bubble take centre stage, but history has shown us that even when market impacts are severe, there is always recovery.

Ultimately staying calm and objective and avoiding the temptation of panic and knee jerk reactions, is central to keeping any financial plan on track for success, as missing out on the markets’ best days can be extremely damaging to returns in the short and long-term.

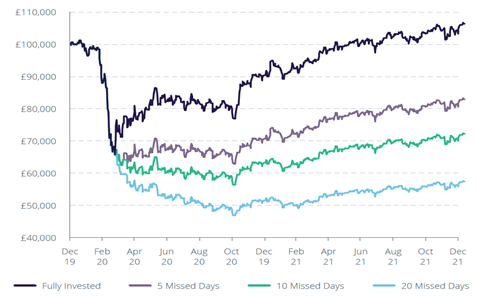

The effect of this can be demonstrated by examining four different return profiles of an investor in the FTSE All-Share index from 31 December 2019 to 31 December 2021.

Source: Morningstar. Based on initial investment of £100,000 in the FTSE All Share index. Bid-bid returns from 31 December 2019 to 31 December 2021. Net Income reinvested.

Remaining fully invested during this extremely tricky period would have produced a positive return of around 6.7%.

But had the investor missed out on just the five best days of positive returns over the period, that return drops to -16.8%. And had they missed the best 20 days as a result of timing the market – many of which occurred around the point of ‘maximum fear’ in spring 2020 – the return would have been -42.6%.

This clearly demonstrates that it has never been more important to adopt a consistently applied methodology when investing and remembering the importance of long-term planning, whatever the socio-economic situation.

And these return profiles speak volumes as while short-term volatility may feel unsettling, taking time out of the market can have a far more significant impact.

At all times it is crucial to stay focussed on your financial plan and long-term goals. If you need to discuss your options or have any questions about investments, you can speak to a financial adviser.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |