Market Updates

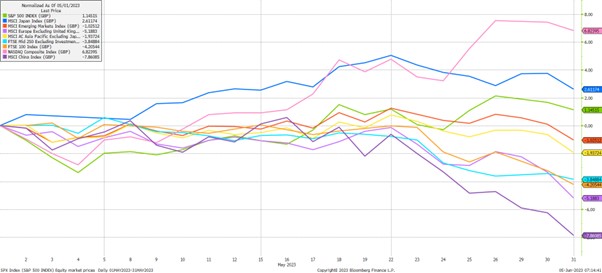

In equities, as the first chart below shows, we saw outlying index performance to the up and downside, with the techheavy US NASDAQ index (in pink) the best performer by far, rising by 6.8% in GBP terms over the month and extending its very strong start to 2023 deep into the second quarter:

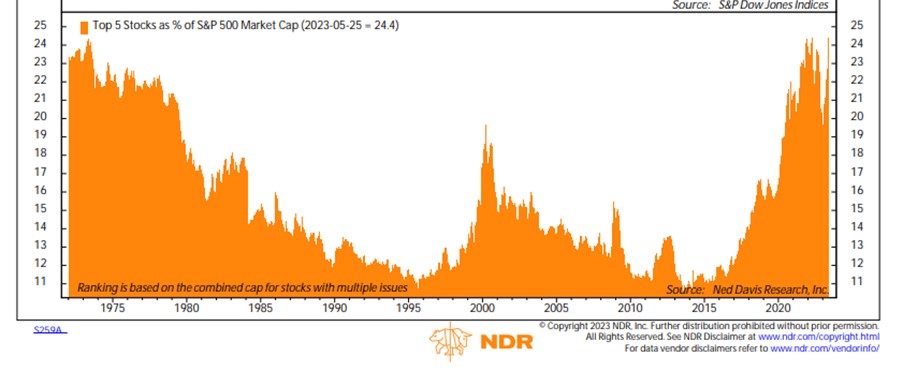

What has become increasingly apparent, however, is that the very strong performance both here and in the broader US S&P 500 index has been driven by a very small number of stocks, with NVIDIA being the most notable example, having risen by c.165% just this year to reach a market cap of $1tn. While we don’t think the situation is as extreme as was seen in 2020/2021 (yet), there are concerns over the level of valuations starting to be seen in this space.

To illustrate this, the second chart below shows the proportion of the US S&P 500 index that is comprised of the top 5 largest stocks by market cap. After a steep drop through 2022 as tech-related stocks underperformed the wider market, this measure has now reached a new peak, indicating a high level of optimism; indeed Apple and Microsoft on their own are astonishingly now nearly 15% of the index:

At the other end of the performance spectrum, Chinese stocks (in dark purple) had another poor month, falling by 7.9% in GBP terms, and suffering from many of the same issues discussed in prior months; namely the inclination of investors to fully focus on any negative news rather than positive. To our eyes, while macroeconomic data in China has disappointed somewhat relative to very lofty expectations, their recovery and reopening post-Covid continues to be solid, and with inflation fully contained for now, the possibility of further monetary and fiscal stimulus is apparent.

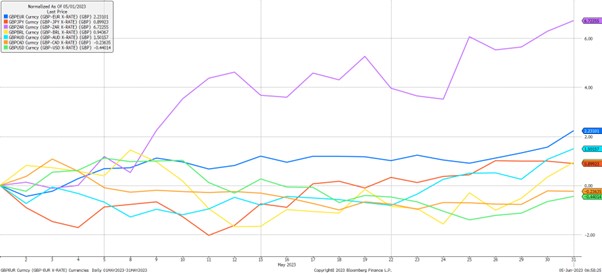

Once again, a very strong pound was a major contributor to translated equity returns in May, with strength seen versus almost all major currencies, as the third chart below shows.

Against the Euro (in dark blue), the pound rose by 2.2%, and against the Japanese Yen (in orange) it rose by 0.9%. Most notably right at the top of the chart we saw a massive 6.7% gain for the pound versus the South African rand, which has been very weak over the last few months as the country continues to suffer from daily rolling blackouts, and having been accused by the US of facilitating weapons sales to Russia:

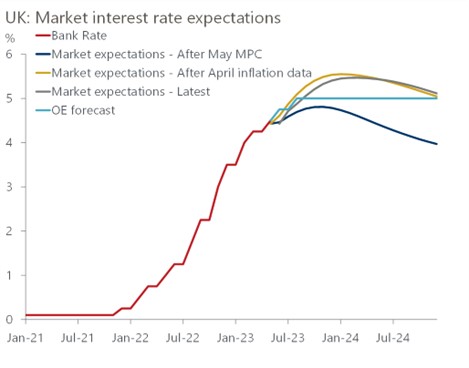

The pound’s strength has most recently stemmed from expectations of higher interest rates being priced into markets by investors following yet another surprisingly high inflation out turn in May of 8.7%, far above consensus expectations. As the fourth chart below shows, interest rate expectations jumped upwards sharply following the release of the inflation data, with a peak of 5.5% now expected later this year:

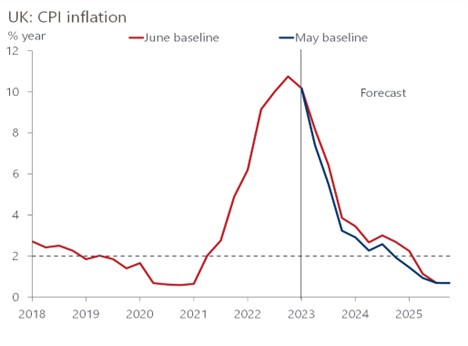

Inflation is still expected to fall sharply throughout the remainder of 2023 as the fourth chart below shows, but what is noticeable is that these expectations keep getting pushed further and further out, the fifth chart below shows the latest forecast for UK CPI in red falling more slowly than just one month before, with further risks remaining here as we move through the year:

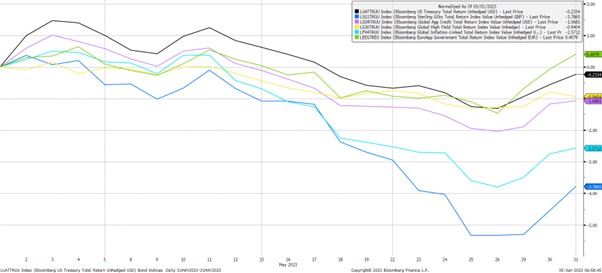

Finally in bonds, the UK’s inflation woes while positive for the pound, were sharply negative again for its fixed income markets. As the sixth chart below shows, UK Gilts (dark blue) were by far the weakest performers again, falling by 3.8% in price terms as yields were driven high by investors reacting to the elevated inflation number. European (green) and US government bonds (black) fared far better, while global inflation linked bonds (light blue) also fell sharply as inflation expectations at the global level continued to fall, and real interest rates continued to rise:

Looking ahead, while we still see the global economy demonstrating resilience in the face of tighter monetary and fiscal policy, we are reminded that recessionary risks are still present. These risks may well edge closer as we move through 2023, especially if monetary policy in particular continues to ratchet higher. Labour markets and spending in the services sector remain robust, but globally, the manufacturing industry appears to already be struggling in what may be an early warning sign. For now however, GDP growth estimates continue to be upgraded in both developed and emerging markets, but despite these improvements, portfolio diversification remains essential.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.