Market Updates

While July’s market returns were somewhat overshadowed by the extreme market volatility that occurred towards the end of the month and into August, we saw some interesting narratives developing through the month as the global macroeconomic data picture continued to develop.

July proved to be a volatile month in the round as markets digested a number of notable economic and political developments. A weaker than expected US Consumer Price Index (CPI) reading early in the month, combined with weaker US labour market data, reassured bond investors that the Federal Reserve (Fed) will soon begin cutting interest rates. Investors now expect the first Fed rate cut in September and are currently pricing multiple US rate cuts this year.

In the US, earnings season continued with four of the ‘magnificent seven’ reporting results for the previous quarter. Broadly, investors appeared underwhelmed by the releases, resulting in the tech sector coming under pressure for most of July before a rebound into month end. With over half of S&P 500 companies having reported, more than two thirds have beaten analysts’ expectations, suggesting a resilient US economy is contributing to a broadening of earnings. Concurrently, this year’s laggards played catch up in July, with investors shifting towards small-cap equity stocks, which are more sensitive to interest rate cuts. This shift led to the largest one-month outperformance of the Russell 2000 versus the Nasdaq 100 in over 20 years.

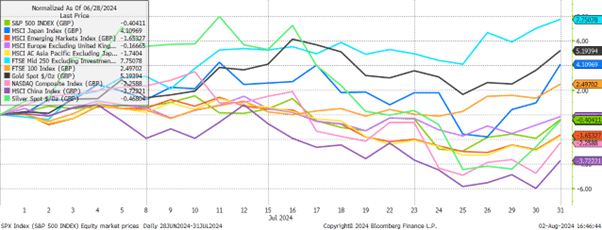

The first chart below shows that most equities indices were negative to some degree, with the US (green line) falling by 0.4% in GBP terms. Chinese equity markets had another weak month, due to continued challenges in the real estate sector and the spillover effects on the broader economy. The MSCI China Index fell by 3.7%, however the Chinese authorities continued to implement measures to provide liquidity support to the financial system, including cutting key interest rates:

At the other end of the spectrum, UK equity markets were particularly strong through July, benefitting from strong macroeconomic data, and (to a lesser extent perhaps) a post-election honeymoon bounce. The FTSE 250 (light blue line) rose by 7.8% and the FTSE 100 (orange line) by 2.5%.

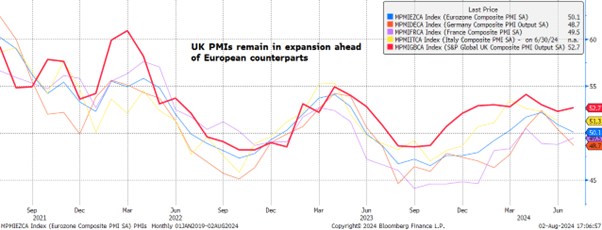

The UK saw surprisingly strong GDP data released during the month, along with various forward looking numbers that were also positive. The second chart below shows Composite PMI indices for the UK (red highlighted line) and various European regions, which are useful survey based indicators of future growth across manufacturing and services business segments. The UK has been diverging from Europe in recent months; continuing to grow while Europe is showing signs of stagnation, led particularly by Germany and France.

For now, the UK’s trajectory seems more optimistic than it has done in a number of years, with sentiment seeming to have turned amongst global investors. As UK equity markets remain cheap, we are hopeful that a shift in capital flows will continue to benefit domestic stock market returns:

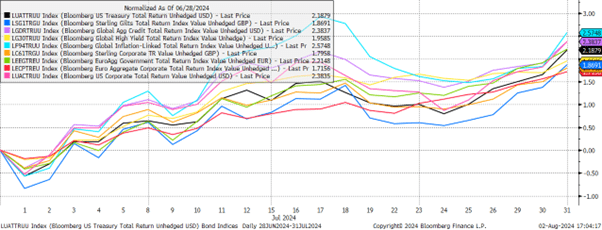

In fixed income as implied above, performance was strong across the board as expectations for earlier interest rate cuts in the US were bolstered by a soft CPI print and a labour market seemingly weakening at the margin. The third chart below shows how this optimism boosted all major bond indices, with US Treasuries (black line) rising in value by 2.2% over the period.

In the UK, the stronger than expected GDP growth seen in the second quarter, combined with persistent services inflation, suggested that interest rate cuts may be more gradual compared to the US and Europe. As a result, UK Gilts (blue line) marginally underperformed, returning 1.9% over the month:

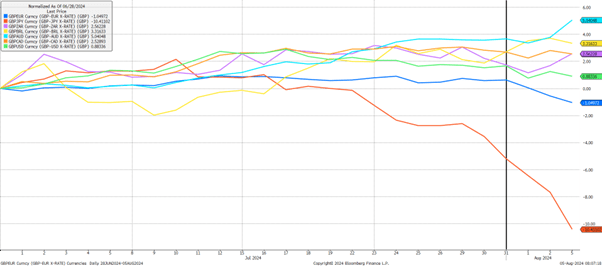

Finally, global currency markets were the epicentre of a short, sharp period of extraordinary volatility that unfolded in the final days of July and first days of August, with the ructions centred around the Bank of Japan (BoJ) and the Japanese Yen (JPY).

The BoJ decided to raise interest rates unexpectedly to 0.25% on July 31st, and couple that move with a surprisingly hawkish tone. This provoked very large upwards moves in the Japanese Yen as what is known as a ‘carry trade’ unwound.

A carry trade very simply is being ‘short’ a low yielding asset and being ‘long’ a higher yielding asset. Another way to think about it is borrowing at a low rate to invest at a higher rate elsewhere.

The Japanese Yen has traditionally been a popular source of funding for such trades as borrowing rates have been extremely low for a very long time, and the currency has been steadily depreciating, providing additional gains for those brave enough to be unhedged.

Unfortunately, this relationship is prone to sudden, painful reversals as the elastic is stretched tighter and tighter. Investors have borrowed money in JPY to then invest across a swathe of asset classes from emerging market debt through to large cap US tech stocks, with these most popular winners aggressively selling off as margin calls were made.

The fourth chart below shows various global currencies versus the pound, with JPY (orange line) strengthening to the tune of 10.4% in a matter of days – a near unprecedented move. Japanese equities also sold off very sharply, at one point falling by more than 12% in a day, and while something of a recovery has since taken place, at the time of writing the MSCI Japan index is down by some 6% since 31st July:

Our sense from our own research and from conversations across the industry is that while the volatility is painful, it is more due to the technical factors described above, and is not the start of a spiral into a serious recession. On the afternoon of 5th August for example, markets were partially calmed by stronger than expected data on US services businesses.

Nevertheless, there are undoubtedly large imbalances in financial markets today as we look at the valuations picture in equities in particular, but we don’t believe a 12% one day move in one of the world’s largest equity markets is justified by fundamentals.

Uncertainty will be high looking forward as we continue to experience volatile macroeconomic data, fractious geopolitics and the possibility of a worsening tech stock outlook, but our long-term thinking should remain resolutely in place.

We have over 1000 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.