On the whole, momentum in stock market growth has slowed dramatically from its pace through 2020 and into early 2021, a reflection that the initial post-pandemic economic resurgence may be nearing its peak.

Chinese stocks have largely sold off through the latter half of July as a result of further corporate crackdowns – this time targeting the for-profit education sector. As the latest in a string of regulatory interventions – we’ve previously seen moves against technology conglomerate, Tencent; financial technology firm, Ant Group; and ride hailing firm, Didi – investors in the region are becoming increasingly cognisant of the long-term impact of these policies, and how they will affect growth. That said, it is widely agreed that there are many logical explanations for these moves, many of which are in line with Xi Jinping’s broad agenda to create financial stability, greater equality and support national security. Accordingly, some are speculating that the moves being made against the technology sector represent an attempt to encourage investors into allocating capital towards high-tech manufacturing sectors and away from consumer internet services, the latter of which are seen by some as being a drag on productivity.

The slump in Chinese equities filtered through into broader emerging market stocks, where economic growth remains sluggish and virus-related challenges persist.

At a corporate level, the past few weeks have been busy for second-quarter earnings announcements, with Amazon reportedly missing its quarterly sales estimates for the first time since 2018 and Netflix reporting a larger than consensus fall in new users.

On the whole however, it has been an incredibly strong earnings season, reflected in an encouragingly high ratio of earnings beats to misses. We do note that some business leaders are becoming wary of investors reading too much into these figures, given the comparative period is Q2 2020, when much of the world was shut down. Apple Inc., for instance, provides an interesting case, with strong results that were later damped by CEO Tim Cook warning investors that global semiconductor shortages will continue to put downward pressure on Apple’s core business through the remainder of 2021.

On the global stage, there are signs that such shortages are beginning to abate within the auto sector, with statements coming from TSMC, one of the world’s leading chip producers, inferring that while backlogs are being cleared in the auto space, bottlenecks are in turn being created in other areas. Commentators expect this to continue weighing on global supply chains over coming months.

Notwithstanding ongoing disruptions in some areas, the majority of developed markets are now experiencing strong rebounds. We have previously commented on bourgeoning manufacturing Purchasing Managers’ Index (PMI) data from the US and UK, figures now coming out the Eurozone show record high confidence in the bloc, while similar data relating to services sectors also evoke confidence.

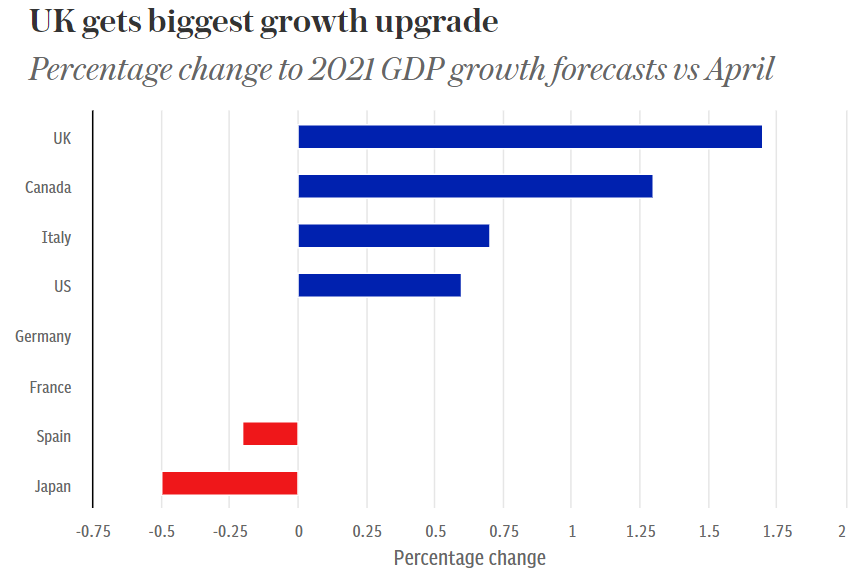

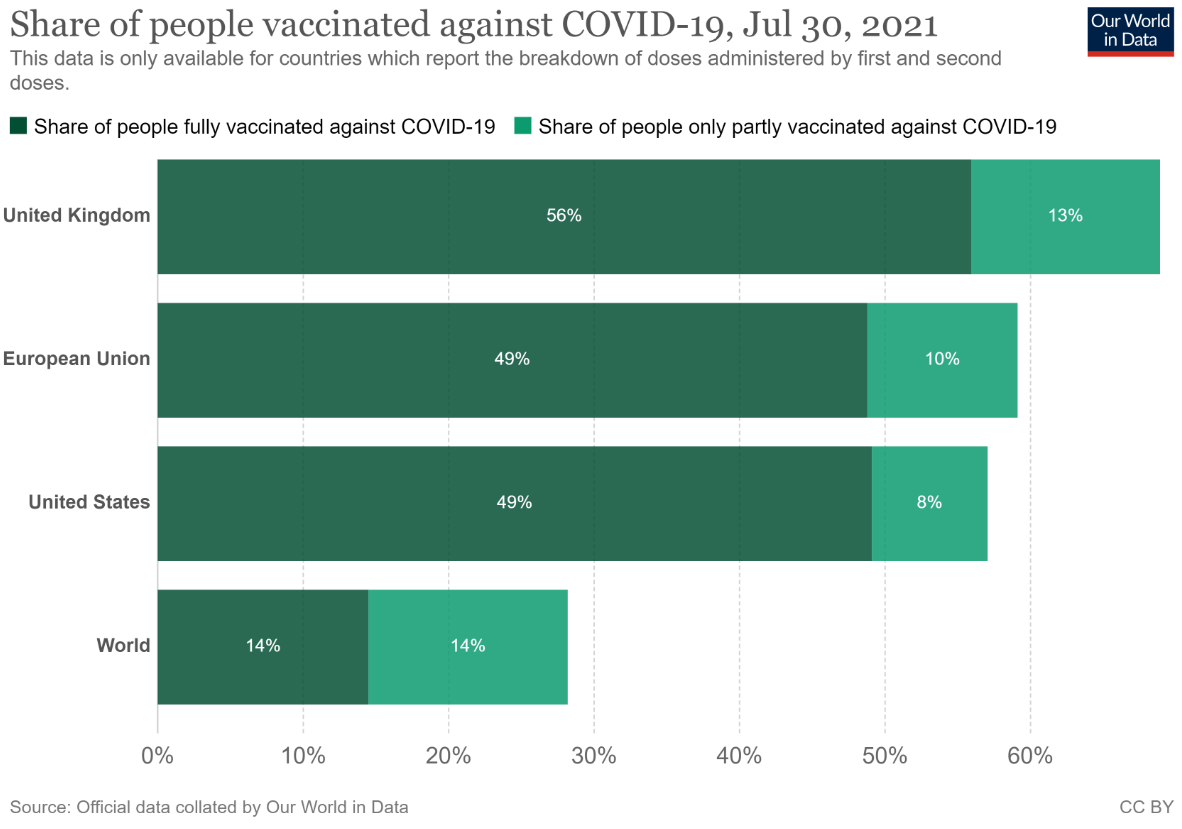

The UK’s economic growth outlook has been brought into the limelight this week, with the International Monetary Fund (IMF) predicting growth in the region will hit 7% this year – a rate that within developed markets will likely only be matched by the US. Such a strong move upwards from its previous estimate (5.3%) is reflective of the IMFs confidence in the UK’s world leading Covid vaccination programme.

While virus case numbers associated with the highly contagious ‘Delta’ variant continue to soar globally, countries with a good level of vaccine coverage are managing to avoid rising hospitalisations and continue with economic re-openings. As highlighted in the IMF’s growth downgrade of Japan, the economic risks of the spreading ‘Delta’ variant are already being seen in nations where vaccine roll outs are less advanced. Emerging markets are expected to be most affected by this, as governments continue to impose restrictions on activity.

The growing share of vaccinated people in the US and European Union has led the UK Government to announce a change in policy, beginning Monday August 2nd, that will allow fully vaccinated individuals from the two regions to enter the UK without having to quarantine. This move represents a huge step forward in our route to normalisation, with industry leaders and the opposition now pressing the Government to remove the requirement for fully vaccinated UK nationals to self-isolate.

Overall, we are still seeing a mixed picture going forward. While global growth, as driven by the economic goliaths of the US and China is starting to slow, the Eurozone and Japan still have a good way to go, as neither have yet returned to their pre-virus growth pathways. Despite disruptions still being apparent in some areas, goods shortages globally are beginning to ease and are expected to continue doing so over the coming months, reducing price and inflationary pressures. Further, falling commodity prices are alleviating cost pressures within manufacturing sectors, which again, should allow inflation to fall back from its recent highs.

Historically, markets tend to be particularly rocky through August and September, rarely making any sizeable moves upwards. We thus move into the mid-summer month with an expectation for volatility, albeit with the continued belief that outperformance of risk assets will persist through the remainder of the year.

Imogen Hambly (Portfolio Manager)

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.

For further information, please contact:

For further information, please contact: