Market Updates

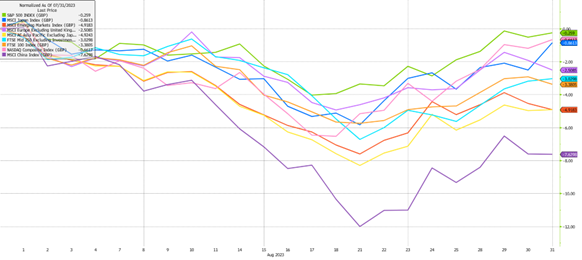

Global equity markets returns were largely negative through August, with the global equity index losing 1.2%, in local currency terms. On a regional basis, Asia and emerging markets underperformed, largely due to a swing back towards negative sentiment in Chinese equities. In pound terms, the MSCI Emerging Markets index (shown below in red) and MSCI Asia ex Japan index (below in yellow) were both down 4.9%.

Elsewhere we saw strong relative performance from US and Japanese equity markets, following the trends we have seen for the majority of the year so far. Japanese equities have , as well as positive equity market reforms.

Looking at the US market, August brought a close to the Q2 earnings season, with particularly close attention paid to , the semiconductor design business, who reported on the 23rd of August, stating very strong growth in both revenues and profits for Q2, . The question remains, how much of this future growth is now priced into the shares, with the company now valued at over $1 trillion

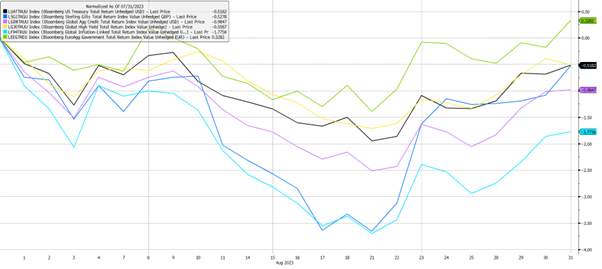

Looking at the bond market, we saw major indices finish , with significant volatility throughout the month as conflicting economic data pulled markets in different directions. Below you can see that Gilts, in dark blue, struggled through most of the month, as the market digested the recent inflation data that came in at 6.8%. This was largely in line with expectations but not as low as some had hoped. This confirmed that we will likely see another hike of interest rates at the Bank of England’s next policy meeting later in September. However, Gilts then rebounded significantly towards the end of the month as investors felt these were now too oversold and weaker than expected economic data put a ceiling on how much further these rate hikes were likely to go.

The most significant weakness came from the Global Inflation-Linked index, in light blue, which has a high level of duration and is therefore the most sensitive to interest rate expectations. The poor performance came from stronger than expected economic data in the US, which prompted investors to price in interest rates being “higher for longer”. This view had further fuel added when Jerome Powell, Chair of the Federal Reserve, commented that they would stick to their mantra of “getting the job done” on inflation at the Jackson Hole Economic Symposium. These comments and the economic data pushed US Government Bond yields up, and their prices down, particularly those bonds with a longer duration (10 to 30 years).

However, as you can see from the above chart, the Global Inflation-Linked index then rallied over the last few days of the month. This was due to weaker than expected labour related data from the JOLTS (Job Openings and Labor Turnover Survey) report, which led investors to think it was less likely that we would see another interest rate hike during 2023. This highlights the difficulties that investors are facing in the current environment with conflicting data points moving prices quite significantly and all within a couple of weeks.

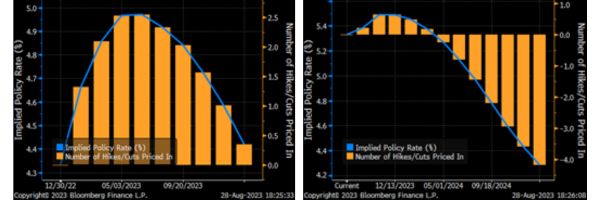

The charts below show the US Federal Reserve interest rate expectations that were being priced into the market in January 2023 (left) and then as of August 2023 (right).

As you can see, the January expectations suggested we would have taken rate hikes too far by now, and the Fed would have been forced to cut to lower than 5%. However, this has clearly not been the case, as rates are above that 5% level and expected to stay above unti mid-2024. As mentioned in last month’s report, the end of the rate hiking cycle is something both equity and bond investors are keeping a keen eye open for.

The other key topic of conversation this month was the ongoing issues with China’s property market, as the troubled developer Evergrande filed for bankruptcy, and The Country Garden reported record losses. The issues started when the Chinese Government decided to regulate the level of debt these developers were allowed to have; a problem that was then compounded as property sales have continued to slow. Officials have incrementally dialled up support for the market, by lowering mortgage rates and relaxing home-purchase restrictions in smaller cities, but to no significant effect yet.

We believe Chinese policymakers are trying to reduce the economy’s reliance on real estate over the long term, which would explain their reluctance, so far, to pursue a major property-market stimulus. Instead, they are opting for more targeted stimulus in order to hopefully place the economy on a healthier trend over the medium-long-term.

Looking ahead, we feel it remains key to be diversified across asset classes and regional equity allocations. August has been a great example of how economic data can pull markets, quite significantly, in different directions in the short-term as conflicting data is digested by investors. With regards to equities, we feel it is important to stay focussed on valuations, underlying earnings growth and corporate cost controls, as this will likely provide portfolios with more protection should global growth continue to trend downwards while interest rates remain elevated.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.