Market Updates

Both equities and bonds were weaker in April as the conflict in eastern Europe, Chinese lockdowns and the prospect of tighter monetary policy weighed heavily on investor sentiment.

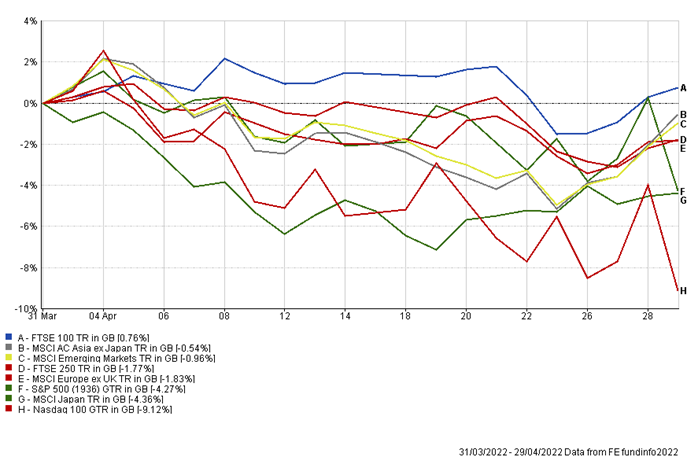

As the first chart below shows, only the large-cap, value-biased FTSE 100 index was positive for the month, rising modestly by 0.8%. Asian and Emerging Market indices were close behind, though negative, with the worst numbers seen in the US, with the S&P 500 falling by 4.3% in pound terms, and the tech-heavy Nasdaq by just over 9%:

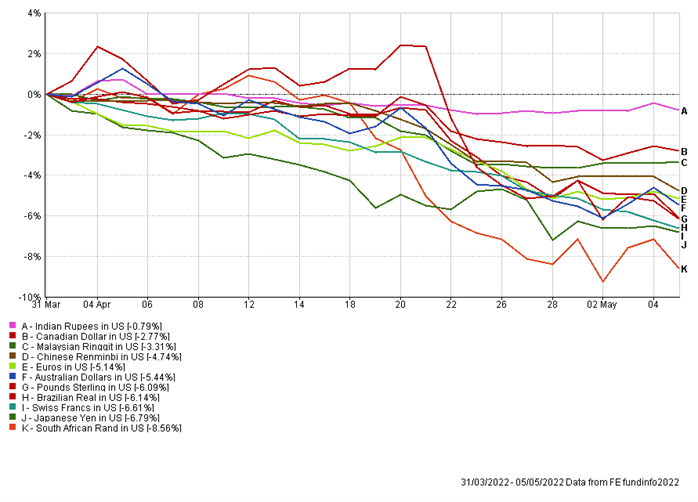

In fact, returns for US equity holders would have been significantly worse had it not been for the strength of the US dollar over the same time period, as the currency benefitted from safe-haven flows, and anticipation of higher interest rates. As the second chart shows, the US dollar rose against all major currencies; substantially in many cases, including by 4.3% against the pound. This move meant that returns for UK investors were improved when translated back to pounds:

Fixed income markets fared little better, and in several cases suffered more than equities. Buffeted by high levels of inflation and hawkish central banks, bond yields rose, and prices fell across the board, from government to high yield bonds.

Expectations for the path of monetary policy have seen a major shift this year, with markets now pricing in interest rates of well over 2% in both the US and the UK by the end of 2022, while Eurozone rates are expected to move into positive territory later this year.

As the chart below shows, major global bond indices suffered falls of between 3-6% over the month, with the assumed relationship between bonds and equities breaking down spectacularly; government bonds were certainly not a safe haven asset in this instance:

Bonds have proved unusually weak throughout 2022 to date, with the chart below illustrating this for the US government bond market – arguably the most important bellwether available given the asset class’s importance as pristine, US dollar denominated collateral within the global banking system.

The chart shows percentage point, quarterly return bars for the US government bond price index going back nearly 50 years, with the final two highlighted red bars denoting returns for Q1 2022, and Q2 2022 to date. Q1 2022’s return was the worst in the index’s history, with the quarter-to-date return also proving negative thus far; a scenario that played out elsewhere within bond markets, if not quite to such an extreme extent:

Central bankers are stuck between a rock and hard place. On the one hand it is imperative that they be seen to be responding to levels of inflation not seen in 30 years. On the other they are aware that growth is already slowing for a multitude of reasons, not least among them a severe and growing cost of living crisis for consumers. They are increasingly aware that rapid and concerted interest rate hikes – which in isolation may well be needed to tame inflation – might tip economies into recession.

For now, labour markets remain robust and large amounts of pent-up savings mean that consumers’ balance sheets remain relatively robust, but downside risks appear to be growing. As per last month, uncertainty will reign until a genuine improvement occurs in Europe, and we see signs of restrictions being loosened in China. As always this speaks to the importance of diversification across portfolios.

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

For further information, please contact:

For further information, please contact: