This pattern of returns is largely mirrored when you look back over the past twelve months, with local currency returns of US growth assets sitting well above those of other regions. Valuations of top performing areas continue to look stretched versus historic levels.

As we move further into the economic recovery, we are still seeing the effects of Covid-19 related lockdowns play out in equity returns, with consumer behaviour driving activity levels and ensuing inflation.

Regionally, US equities were comparatively strong on the back of solid earnings growth and the possibility of more fiscal stimulus. The S&P 500 returned 2.30% in dollar terms over the month, a figure that when translated into pounds was boosted to 5.00% due to a stronger US Dollar. Through June we have seen US inflation prints surprise to the upside, with core CPI (CPI excluding more volatile food and energy prices) hitting 3.8%, one of the highest levels in thirty years. Labour market data continued to improve as US weekly jobless claims fell to a pandemic era low of 364,000 and employers added 850,000 nonfarm jobs, well above the expected figure of 700,000.

These data points coincided with the first explicit hints from the US Federal Reserve (Fed) that a tightening of monetary policy is being considered. Following their June meeting, Chairman Jerome Powell stated that a discussion would begin about scaling back quantitative easing purchases used to support financial markets and the economy during the pandemic. Forecasts from the Fed were also released that suggested interest rate hikes are now anticipated in 2023 – sooner than many thought – with higher inflation mentioned as a causal factor.

Closer to home, European stocks gained as strengthening vaccine programs allowed for the lifting of more restrictions, while burgeoning global demand boosted manufacturing sectors. The European Central Bank intends to keep monetary policy in the region extremely loose, maintaining low interest rates and keeping asset purchases at current levels for the remainder of the year. Bolstered by such an accommodative central bank, surveys indicate that European business confidence is now at the highest level since 2012, when forward looking sentiment data became available.

In the UK, equities failed to make meaningful ground, with the FTSE 100 closing the month up only 0.41%. Despite this, the UK economy continues to rapidly recover, with the latest estimates from the Bank of England putting current economic output at just 2.5% below its pre-Covid peak. We are also starting to see a tightening of the labour market, amid reports that online job postings are back above levels seen before the pandemic.

On the supply side, commodity prices eased a little through the month, as China released some of its strategic metal stockpiles to the market in an attempt to relieve conditions within the country’s manufacturing sectors.

Elsewhere, supply chains from car manufacturers to electric toothbrushes and tumble dryers continue to be affected by semiconductor shortages. Despite pressures easing a little, it is expected that constraints are set to weigh on output for the remainder of year, tailing off only as we move into next year and both consumer demand lessens, and corporate inventories are rebuilt.

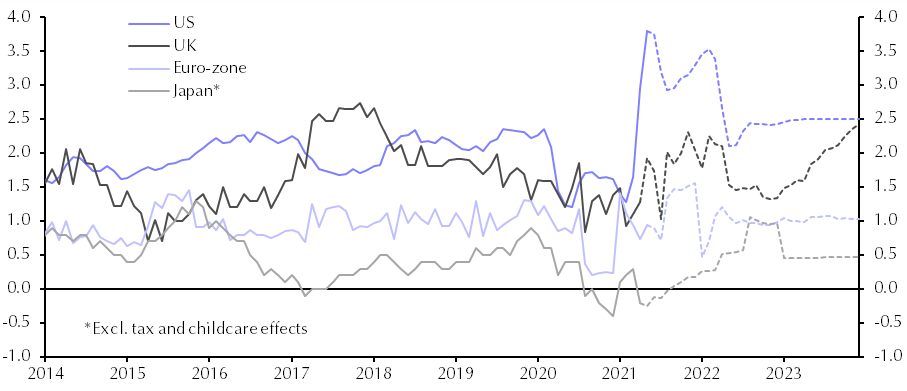

These supply and demand pressures that have been caused by the strength of developed market economic normalisations are not only leading to inflationary spikes in the US, but in other regions also. The chart below shows Capital Economics’ core CPI forecasts for various regions, with the UK set to remain elevated at least through 2023:

Despite these large upwards moves, central banks remain laissez-faire about the situation, describing current conditions as transitory. While there are reasons to agree with the stance, the sheer volume of stimulus that has been injected into global markets since the outbreak of the pandemic leads many commentators to believe inflation levels are likely to remain structurally higher versus levels seen in recent years.

As global economies move further towards a synchronised recovery, we will look to garner a better understanding of the long-term inflationary picture.

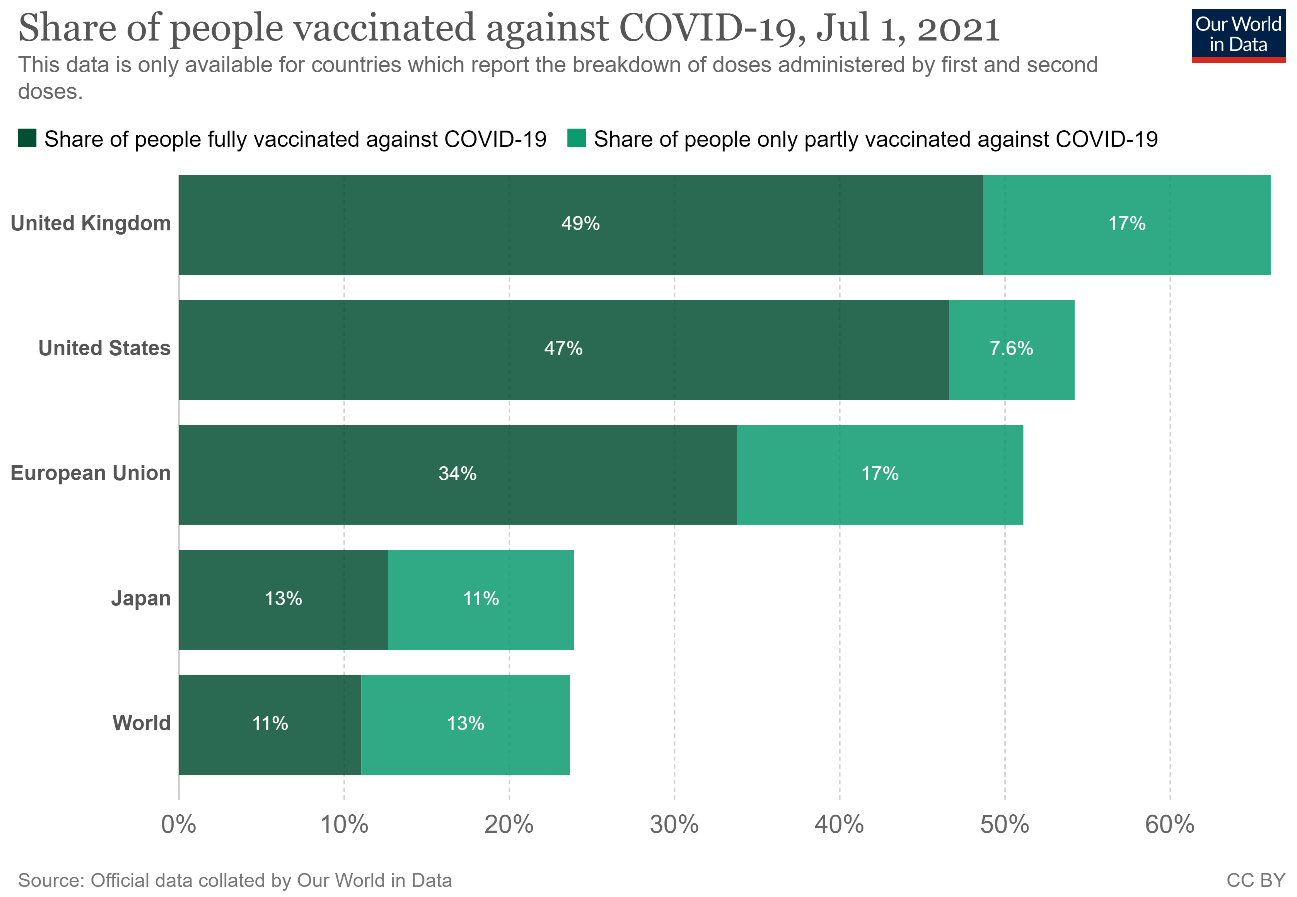

With the Olympic games less than a month away, June saw Japan reach its target of administering 1 million vaccines per day. This may be a milestone for the country, but the figure lags other developed nations and sets the stage for further restrictions to be imposed when the current set expire on July 11th. It is thought that Japanese authorities could extend Tokyo’s current ‘quasi’ state of emergency, which would cap spectator numbers at 5000, albeit Prime Minister Yoshihide Suga has also mooted the possibility of holding the games with no spectators.

Back at home, the UK has now fully vaccinated over 60% of the adult population, with Europe and the United States following closely behind. It is unlikely that we will see restriction-free international travel this summer, but with the home nations having now lifted the majority of domestic restrictions, another year of staycations will benefit local tourist spots.

Looking forward, we maintain our expectation that outperformance of risk assets will persist through 2021, with a preference for shorter duration assets that offer an increased level of inflation protection. In equity this relates to a value bias versus growth, while shorter maturity bonds are preferred versus their long-dated counterparts. Regionally, we continue to favour the more undervalued areas, namely the UK, Emerging Markets and Asia, albeit we expect volatility as we grapple with evolving fiscal and monetary policy, in addition to virus related disruptions. Inflation is set to stay elevated as we move through the remainder of the year, albeit the extremes seen of late will likely tick down over the coming months as temporary factors ease.

Oliver Stone (Head of Portfolio Management) and Imogen Hambly (Portfolio Manager)

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.

For further information, please contact:

For further information, please contact: