Market Updates

After the drama of March, April was a much calmer month for news flow, thankfully, with no further escalation of the banking system crises. This being said, at the time of writing we must note that over the May bank holiday weekend, First Republic Bank was hurriedly sold to JP Morgan after a slow descent into trouble following mass deposit outflows. This is another Californian bank originally caught up in the troubles that engulfed SVB but that had managed to limp along for another month, but, as of Monday 2nd May, all 84 branches of the bank will reopen as JP Morgan branches.

The consensus around this situation more broadly is still that it’s an issue concentrated in a segment of poorly run, smaller, lightly regulated US regional banks, and that it isn’t particularly contagious, but it is one that requires close monitoring.

Generally, economic data releases in April showcased a positive month for the global economy, with growth still remaining remarkably resilient in the face of higher interest rates. US, Eurozone, and UK Purchasing Managers Index (PMI) surveys all beat expectations, and China’s Q1 GDP print was also stronger than expected.

Falling energy prices helped bring headline inflation down in the major developed economies with the contribution from energy turning negative in the US and the Eurozone. In the UK, although fuel prices fell, the contribution to the overall inflation number from the broader energy complex remained positive due to the lags caused by the energy price cap.

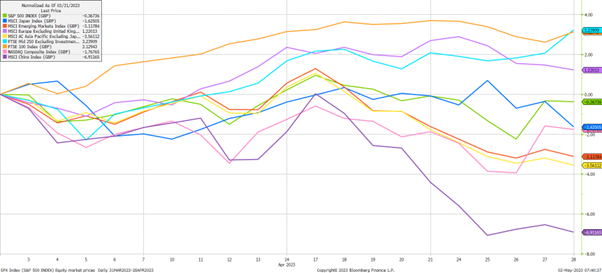

The first chart below shows regional equity indices through April in pound terms, with a strong recovery for the UK’s FTSE 100 (orange line) and FTSE 250 (light blue line) indices immediately visible. These were some of the worst performers in March, with the indices punished for having a more cyclical sectoral composition, but their positive outturns in April perhaps signalled a recognition that their selling was overdone, and also that the UK’s macroeconomic position was proving to be better than expected; GDP growth surprised positively to the upside in Q1 2023, and as mentioned above, leading indicators in the form of PMI business surveys did similar.

Elsewhere, equity market returns tended to be a bit lacklustre, with most other regions negative over the month; Asian and emerging market equities fared worst, dragged down by Chinese equities which fell furthest; ending April nearly 7% down.

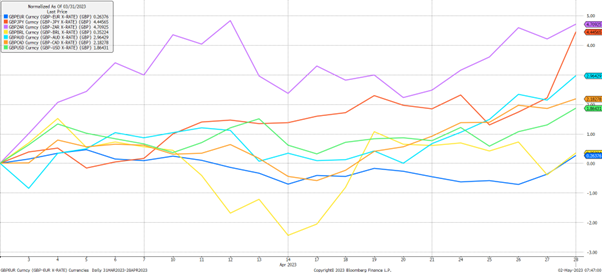

However, as can be seen from the second chart below, a decent proportion of that negative equity price action in pound terms was driven in April by a stronger pound versus various foreign currencies. The chart shows the pound strengthening against all of the illustrated major currencies to a greater or lesser extent through April; significantly so in some cases.

Of particular note was a 1.9% gain versus the US Dollar (green line) and a very large 4.4% gain versus the Japanese Yen (orange line) as the new Bank of Japan governor dovishly surprised the market in his first monetary policy announcement.. Bearing this in mind, in local currency terms, equity market returns were broadly acceptable:

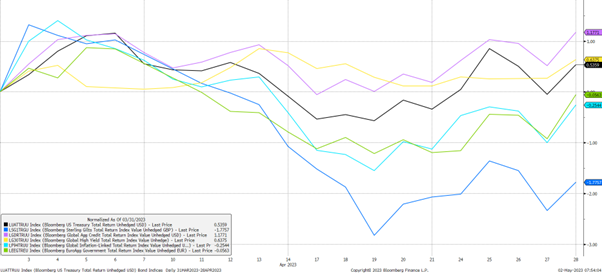

Finally, turning to bonds, we saw a mixed month here after March’s strength. As might have been expected, the safe havens that performed particularly well through March saw some of those gains reversed in April as the bad news receded, so last month’s strongest performers were this month’s weakest.

As the third chart below shows, UK Gilts (dark blue line) saw losses of around 1.8%, driven lower in addition by another sticky inflation print in the middle of month combined with still-hot labour market data. Euro government bond and global inflation linked bond indices were also negative for the month.

Riskier investment grade and high yield corporate bond indices were the best performers, rising in line with equities, with the investment grade bond index rising by nearly 1.2% over the month:

Looking further ahead, while economic data releases remain robust for now, pushing recessionary fears further into the future, given the ongoing rumblings in the US banking sector, it seems clear that the full, cumulative impact of central bank monetary policy tightening is yet to be felt. The Federal Reserve is expected to raise rates by another 0.25% on 3rd May, with the European Central Bank expected to do similar on 4th May, and both institutions are indicating a renewed willingness to continue to fight high levels of inflation. To us this means that despite an improvement in near-term sentiment, portfolio diversification remains essential.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.