Market Updates

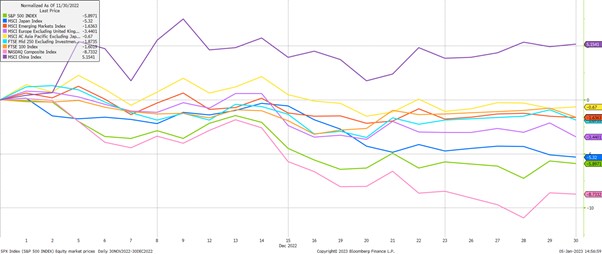

The first chart below shows the performance of regional equity indices through December in local currency terms, with Chinese equities in purple again proving to be the standout asset class in generating a positive return of 5.15%:

As we have expounded over the last couple of months, we believed that the negative sentiment towards Chinese equities was a shorter-term issue, and with sentiment already very low and valuations very cheap, a rebound was more likely than not. China’s reopening from Covid lockdowns is now well underway with the country working its way through a huge wave of infections, and while a full rebound in confidence will take time given the level of consumer repression experienced, solid growth can now be expected in 2023.

Elsewhere, results were disappointing. Broader Asian equities were the best of the rest, falling by 0.67%, with UK and Emerging Market equity indices slightly further back. US indices were again noticeably weaker, with another month of resolutely hawkish central bank rhetoric capping any gains, and a weakening dollar hurting US equity returns when translated back to pounds.

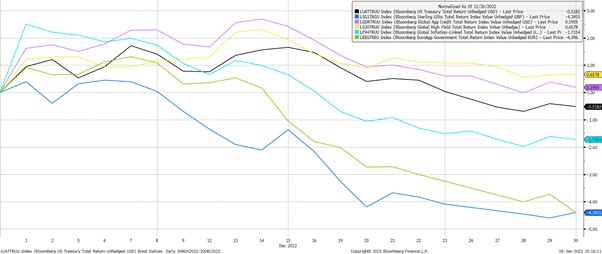

Fixed income markets fared little better, with the second chart below showing that global investment grade (purple line) and high yield (yellow line) credit indices managed to eke out small gains, while government bond markets were negative. Gilts suffered again, falling by 4.39%, with European government bonds falling by a near-identical sum. Volatility continues to be elevated in this space as central banks struggle to calibrate monetary policy, and investors struggle in turn to interpret their behaviour:

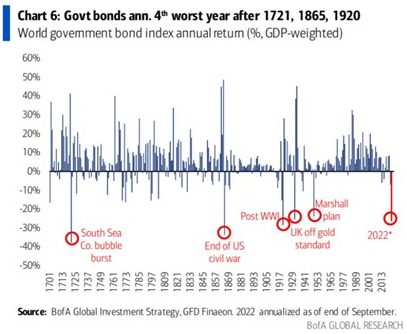

As has been widely publicised, bonds suffered one of their worst years in history in 2022 by almost any measure, with yields driven higher (and prices lower) by central banks desperately trying to tame inflationary impulses. The third chart below from Bank of America shows the returns of a global government bond index going back to 1700 (!) – while that era’s price action has less relevance to today’s, what can clearly be seen is that 2022’s performance stands out like a sore thumb:

2023 has begun with more volatility as central banks seem committed to their running down of inflation, no matter the consequences. How long that sentiment lasts for, only time will tell, but with recessions now firmly forecasted in Europe, the UK and the US, such hawkish rhetoric may only last for so long.

The range of potential outcomes forecasted by economists and strategists for 2023 is, unsurprisingly, extremely wide; our sense is that there will be substantial opportunities as we move through the year, but as always, the importance of diversification across portfolios cannot be overstated.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.