Market Updates

After a strong end to 2021, both equities and bonds had a tough start to 2022, with negative returns driven by a confluence of higher energy prices, inflation worries and hawkish central bank rhetoric.

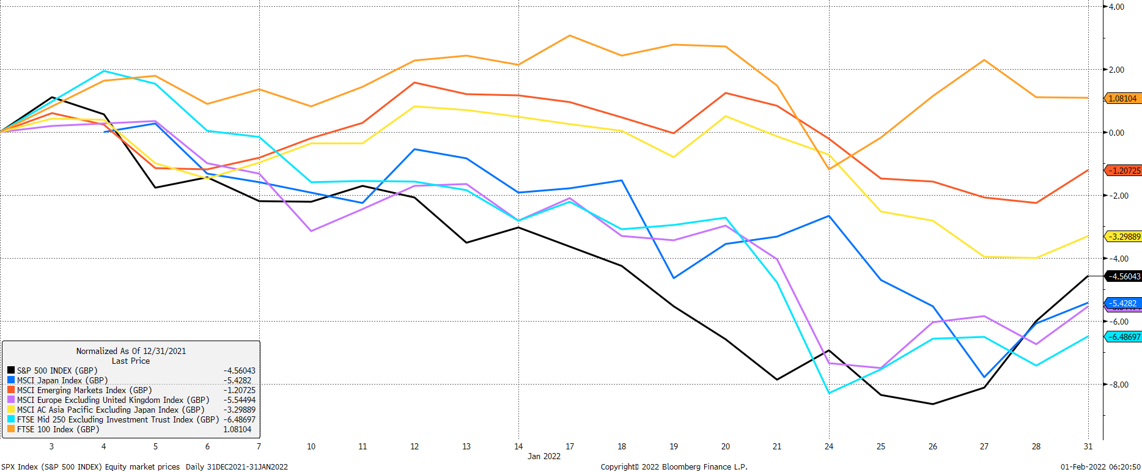

As the first chart below shows, global equity markets generally fared poorly despite a brief respite towards the end of the month, with US, European and Japanese indices falling particularly hard in Pound terms amidst very high intraday volatility. Emerging markets were a relative regional bright spot, falling by 1.2%, but the standout performer was large-cap UK equities, with the FTSE 100 rising by 1.1%:

Albeit over a very short time horizon, this outperformance was welcome following a miserable period for UK equities which have been desperately unloved for some time, despite earnings growth being solid. Valuations attributed to large and mid-cap UK equities are now below long-term averages, with both the FTSE 100 and 250 indices looking cheap in absolute and relative terms.

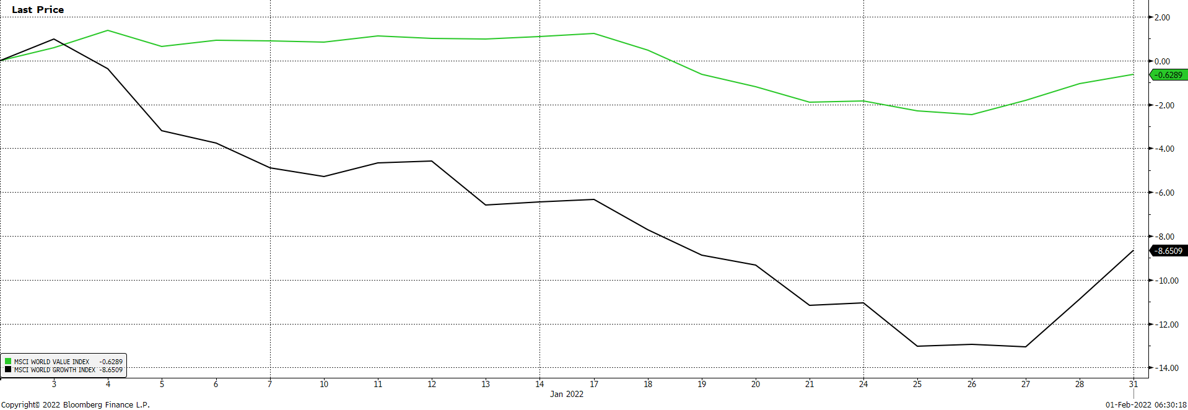

While headline equity index moves were volatile, beneath the surface we saw extremely aggressive rotations at the sector level, with investors choosing to sell more richly valued companies in areas like technology in favour of optically cheaper financial and energy stocks. The chart below captures this phenomenon, showing the relative performance of the MSCI World Growth and Value indices over the month, with the latter outperforming the former substantially:

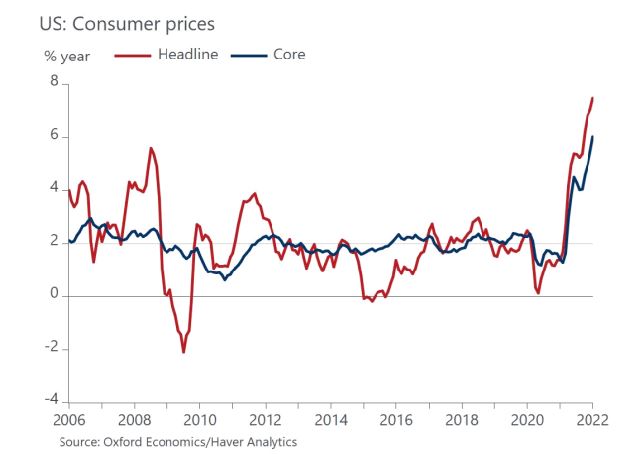

These gyrations were in part driven by a growing conviction that global central banks are set to concertedly raise interest rates materially from the zero bound in response to growing worries around inflation. CPI gauges have continued to precipitously rise across the developed world in particular, as excess demand driven by pandemic response fiscal and monetary stimulus meets constrained supply chains and poorly managed energy policies.

US inflation has now hit 7.5% year-on-year – the fastest rate of increase in nearly 40 years, and while prices are still forecasted to fall later this year, they are expected to remain above 2% targets for some time. Similar is occurring in the UK, where the Bank of England has already moved to raise interest rates, and in Europe, where inflation surprised strongly to the upside in January:

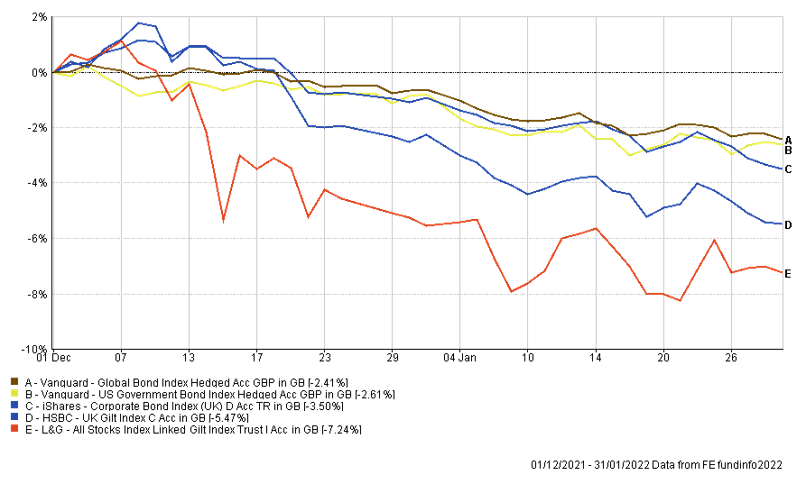

This has led to falling government and corporate bond prices as higher borrowing costs are priced in and investors reduce their positioning across the board. As illustrated below, sharp losses were felt across fixed income asset classes, leaving few safe havens for investors in which to seek shelter:

High volatility across asset classes has continued into February, as commentators become increasingly vocal about central bank largesse having a damaging impact on prices. The risk of a central bank policy mistake appears to be rising, with markets pricing in an increasingly aggressive rate hiking cycle most notably in the US. While a sensible policy normalisation should be welcomed, it seems unclear whether aggressive rate rises will help unblock global supply chains or reduce the price of natural gas, except through explicit demand destruction, which is undesirable.

While elevated risk in equity and bond markets may persist, it is important to note that macroeconomic data remains solid, though less positive than 2021. GDP should rebound in this quarter from an Omicron-impacted Q4 2021, while consumer and business balance sheets look robust. As always, we see intelligent portfolio diversification as the route through this period of relative uncertainty; gaining exposure to a number of differentiated risk and return drivers is of paramount importance.

We have over 650 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Match me to an adviserFor further information, please contact:

For further information, please contact: