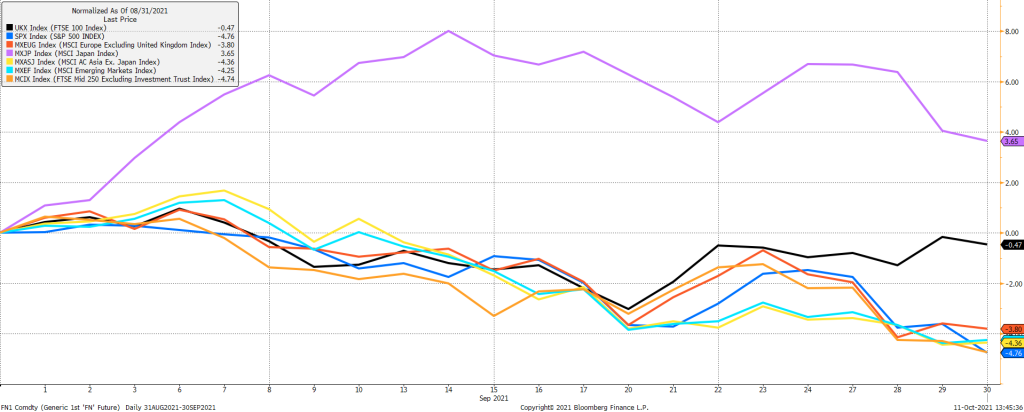

Japanese equities were the standout regional performer through September as markets generally struggled with a combination of moderating growth, more hawkish Central Bank language and rising energy prices:

Japan bucked the trend as markets reacted favourably to the news that the then Prime Minister, Yoshihide Suga, had announced plans to resign after his Covid management was deemed a failure. His premiership ended almost exactly a year after it started, having taken over from previous incumbent Shinzo Abe, who was Japan’s longest serving premier.

Following Suga’s resignation, new Liberal Democratic Party leader Fumio Kishida was appointed Prime Minister by the Japanese parliament, and immediately called for an election at the end of October. Kishida was not the public’s top choice for the job amongst the candidates from within the Liberal party, with the man himself conceding that some see him as ‘boring’, but he has previously served as foreign minister, with first-hand experience of managing relations with Japan’s principal ally, the US, and its largest trading partner, China.

He and the Liberal party are most likely to win the election despite losing seats, with support for the main opposition party mired in single digits but will inherit a difficult brief particularly with regards relations with China, as many voices within the party see Taiwan’s security as an existential matter for Japan, given their reliance on the island’s semiconductors.

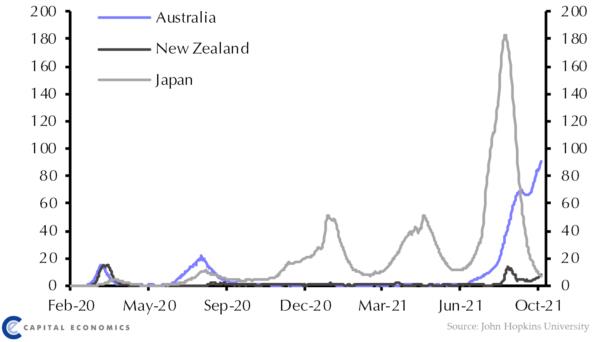

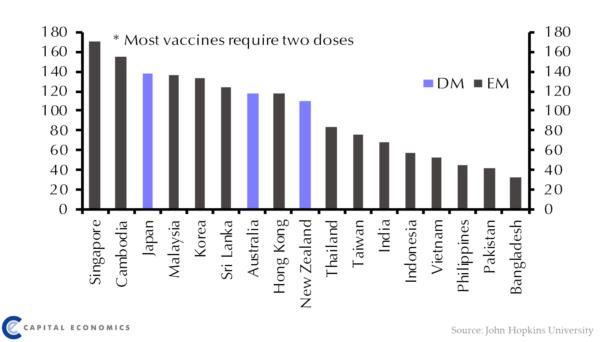

The political change has coincided with a relaxation in Covid restrictions within Japan as new cases have declined to near-zero and vaccination rates have soared, and with strong corporate earnings growth still apparent, the region could see further good performance looking ahead on a medium-term time horizon:

Elsewhere, positive returns were hard to come by, both in equities and fixed income. The latter asset class was affected by inflation and inflation expectations that remain stubbornly high despite calls for them to be transitory, along with hawkish Central Bank rhetoric emanating most notably from the US and UK.

Given how low global bond yields have fallen, the end of extraordinary monetary stimulus should be expected to result in higher yields and capital losses for bondholders, and despite sharp upwards moves in September, yields still remain extremely low by historic comparison, with room to move higher over the next few quarters.

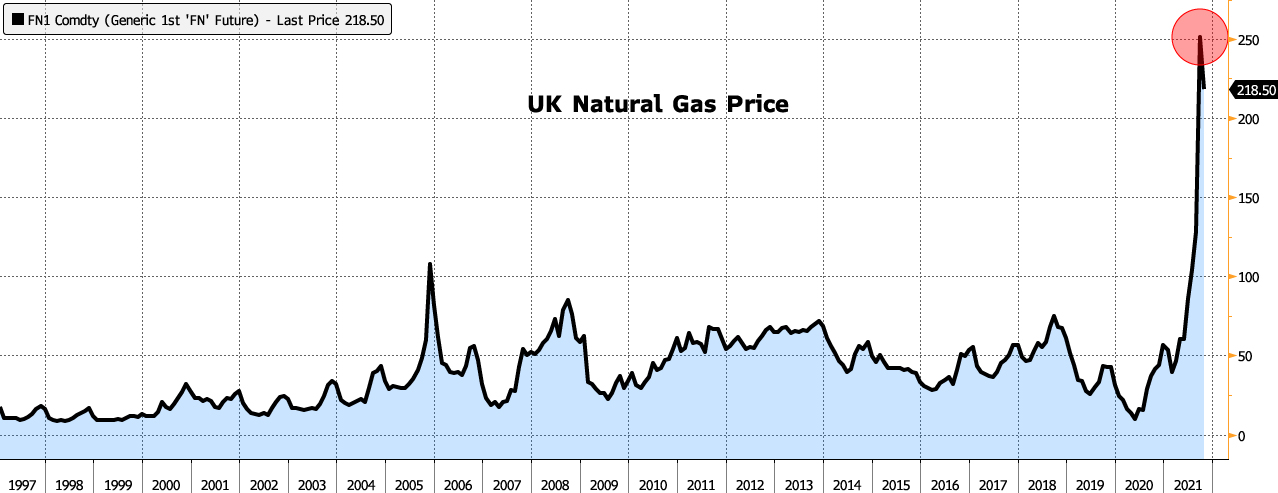

Yields have also been driven higher by inflation expectations, which most recently have been affected by the increasing cost of energy, and particularly that of natural gas. The same has led to growth forecasts being revised down as analysts factor in a higher cost of energy both for businesses and consumers.

Europe and the UK have been affected by this over the past quarter, which has seen prices rise in a ‘perfect storm’ of circumstances to near-unthinkable levels as the chart below shows:

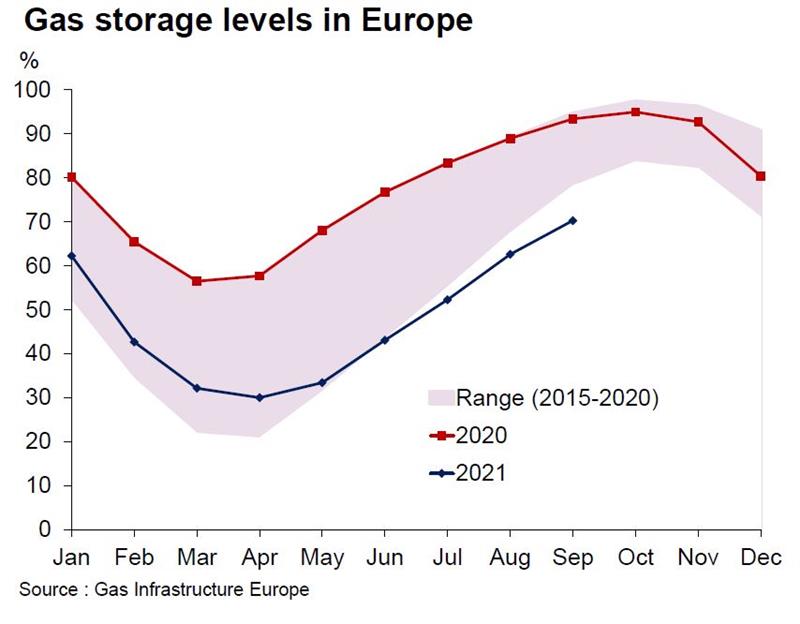

Longstanding supply issues, depleted inventories (next chart below), surging demand and the coming winter mean that prices are likely to remain elevated into next year, albeit not to this degree, with the UK’s reliance on others for supply augmented through underinvestment in storage capacity over the past few years.

The US has also had its fair share of problems with freak storms in Texas earlier this year, the Colonial Pipeline cyberattack in May, and Hurricane Ida in September all having noticeable impacts on gas production, while in China, economic output has been constrained in some regions due to electricity curbs relating to shortages of coal. There, Chinese government officials have ordered the country’s top state-owned energy companies – from coal, to electricity and oil – to secure supplies for the coming winter ‘at all costs’.

These issues are likely to feed into lower growth rates globally in Q4 2021 and Q1 2022, with hits to corporate profits and consumers’ balance sheets yet to be fully known. Despite this, growth is still positive, with lots of slack in labour markets in developed markets to be taken up as fiscal stimulus measures come to an end.

As we mentioned in last month’s note, given very strong gains over the past 18 months, navigating markets was always more likely to be trickier on a forward-looking basis. Opportunities certainly still exist across asset classes however, possibly in those areas related to real assets. As always, we seek to ensure that our portfolios are well diversified by geography and strategy, with exposures to multiple themes, including hedges should the status-quo in markets shift in a different direction.

Oliver Stone (Head of Portfolio Management)

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.

For further information, please contact:

For further information, please contact: