Market Updates

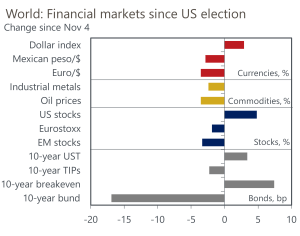

November was a month of profound shifts in financial markets and geopolitics, with the U.S. presidential election at the centre of attention. The election results, policy expectations, and macroeconomic conditions have created a ripple effect across markets, marking a pivotal moment for investors worldwide.

U.S. equities delivered stellar returns in November, with the NASDAQ and S&P 500 advancing 7.4% and 6.9%, respectively. Small-cap stocks took the lead though with an extraordinary 12% rise, signalling renewed optimism for domestic-oriented companies. The election of President Trump for a second term was a catalyst for this rally, driven by investor anticipation of pro-growth policies, including manufacturing reshoring and ambitious spending plans. U.S. markets appeared buoyed not only by immediate post-election positivity but also by the broader expectation of fiscal stimulus and deregulation under a Republican-controlled government.

Conversely, global markets outside the U.S. faced challenges. While the UK and Japan posted modest gains, Chinese and broader emerging market equities lagged significantly, reflecting both geopolitical tensions and internal policy shortcomings. In China, a $1.4 trillion fiscal package failed to inspire confidence as it lacked direct measures to stimulate domestic demand, exacerbating concerns about trade relations with the U.S. The unease around escalating tariffs and their potential global fallout weighed heavily on sentiment.

Currency movements reflected the divergence in regional fortunes. The U.S. dollar strengthened, supported by election-driven economic optimism, while the British pound experienced mixed performance, declining against the yen and dollar but gaining against the euro. Political turbulence in Europe, particularly in France and Germany, amplified the euro’s weakness. In Latin America, Brazil’s real tumbled as President Lula backtracked on fiscal discipline, introducing populist tax measures that rattled markets.

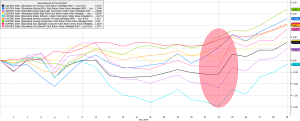

Bond markets experienced a turbulent start to the month, with yields rising amid concerns over increased government spending in the U.S. However, sentiment shifted around 22nd November as highlighted in the chart below, following the nomination of Scott Bessant as U.S. Treasury Secretary; a move that reassured markets of stable financial stewardship. European bonds outperformed, bolstered by expectations of further rate cuts in the face of weak growth and inflation.

Underlying these market movements is a mix of optimism and uncertainty. The Republican sweep in the U.S. elections signals a clear path for Trump’s policy agenda, which includes substantial spending, corporate and individual tax

cuts, and an emphasis on reshoring and trade protectionism. While these measures could sustain U.S. market outperformance, they also bring risks. The spectre of widespread tariffs looms large, with potential repercussions for global trade and inflation. The lack of clarity around the administration’s trade policies has left markets on edge, particularly in regions heavily reliant on U.S. trade flows, such as Mexico and Canada.

Commodities markets have reflected these global shifts, with industrial metals pricing in deflationary pressures outside the U.S., further underscoring the divergence in economic prospects between America and the rest of the world. The broader narrative suggests a U.S.-centric growth story, but one fraught with challenges for global integration and cooperation.

Source: Oxford Economics

Looking ahead, the picture remains complex. On one hand, U.S. markets appear poised for continued strength, buoyed by fiscal stimulus and supportive policy dynamics. On the other hand, rising trade tensions and potential tariff implementations could introduce significant volatility, added to the fact that the valuations picture remains very stretched. The balance of these forces will likely define the trajectory of markets in the months ahead.

For investors, this environment underscores the importance of adaptability and diversification. While the U.S. continues to lead global growth, exposure to other regions and asset classes remains vital to navigate potential headwinds. In this context, our approach remains grounded in disciplined risk management and a focus on long-term value creation.

We have over 1250 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.