Market Updates

September was a busy month for markets, driven by decisions made by major central banks, the Chinese Government announcing a major stimulus package, and a new Prime Minister in Japan.

Starting with interest rates, in September we had meetings from many major central banks, with rate changes being seen in Canada, the US and Europe, while rates were held in the UK and Japan. The Bank of Canada (BoC) and European Central Bank (ECB) both cut rates by 0.25%, having cut rates previously earlier in the year. The most significant cut came from the Federal Reserve, who cut rates for the first time since March 2020, opting for a cut of 0.5%.

The Bank of England however opted to hold rates at 5%, pausing from their first cut of 0.25% back in July. Andrew Bailey, Governor of the Bank of England, mentioned that the committee feel they have a good hold on inflation at the moment, but want to be careful not to cut too quickly, as many economists are noting that labour pressures are higher in the UK than many other developed markets.

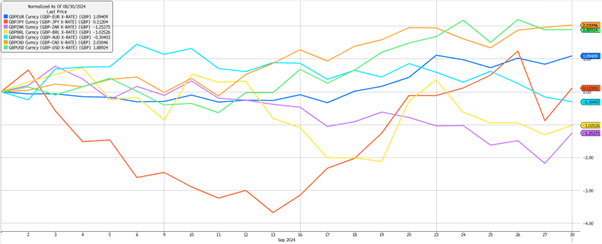

These central bank decisions led to a strong month for Sterling, gaining against most major currencies as shown in the chart above. With most significant gains against the Canadian Dollar and US Dollar of around 2%. It was another volatile month for the Japanese Yen, which gained almost 4% against Sterling during the first half of the month, before giving back all of those gains and ending weaker against Sterling. The weakness followed the Bank of Japan’s decision not to raise rates from the still very low levels of 0.25%. There was also a spike in volatility for the Yen in the last few days of the month, following the news that the Liberal Democratic Party had elected Shigeru Ishiba as the new Prime Minister.

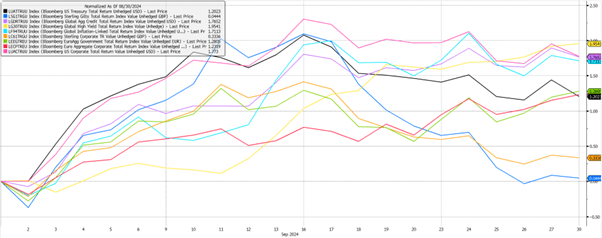

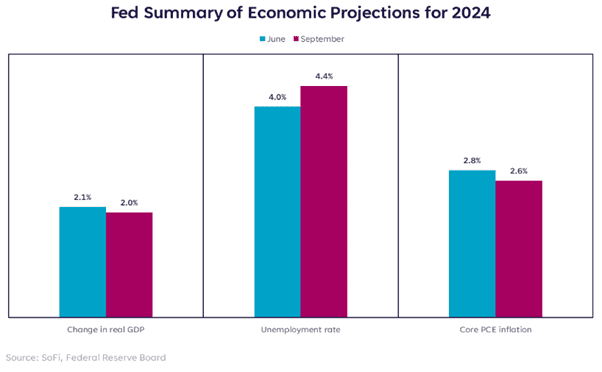

Moving over to bonds, we saw US and global indexes outperform, given the backdrop of falling interest rates and the Federal Reserve (Fed) deciding to start with the larger cut of 0.5%. Going into this meeting, the market was pricing around a 50/50 chance between a 0.25% and 0.5% cut. Fed Chair, Jerome Powell, highlighted that they opted for the larger cut as they were seeing some weakness is the economy, particularly in the labour market, while inflation was deemed more under control. The below chart helpfully explains their thinking around this, and where they think some key economic projections look like now, compared to the June meeting. You can see that real GDP is slightly down from the June prediction, while forecasts for unemployment were higher than they had expected. Then you have Core PCE, which is the Fed’s favoured inflation metric, which was lower than previous estimates.

This meant that, for now, the priority was on the health of the labour market, and while inflation remains more under control, they are willing to act more decisively around how and when they will be reducing rates.

We touched on this last month, and while it was understood that we will be seeing cuts from the Fed, the key remains what the long-term trajectory and how quickly rates will continue to be lowered compared to current market pricing. At the moment, both the Federal Reserve and market pricing is another 0.5% of rate cuts over the next two meetings before the end of the year, however things start to diverge when we look at where expectations of rates are throughout 2025.

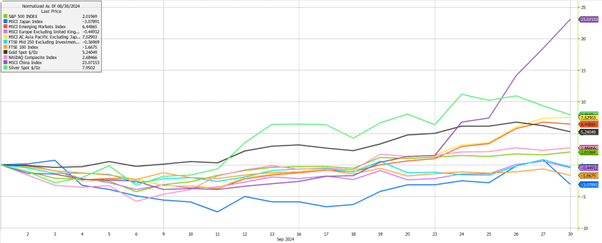

Moving on to equities, we saw quite mixed performance across the major indexes that we usually reference, and all returns in the graph above are shown in local currency. This means that the strength in Sterling we discussed earlier negatively impacted returns when translated back to GBP, particularly for equities listed in the US and to a lesser extent Europe and Asia. The significant outlier here was in Chinese equities, up 23%, as the Government announced the largest package of stimulus since 2020. The measures ranged from reducing interest and mortgage rates, to encouraging local Governments to buy unsold housing, with large capital pools provided to support the equity market and direct payments to help support lower income households.

Some of these tactics have been tried before, with little success, but the key to these measures were that they were both at a much larger scale, and combined as one package rather than done one-by-one. As well as this, the market has been calling for more serious action to be taken to support the property market which has been a major drag on economic growth and consumer sentiment in China. That market has suffered from an oversupply, causing property prices to steadily decline over the last four years. In China, around 63% of household wealth is held in property, so as prices have been going lower, that has been felt very directly by residents, impacting spending, job creation and sentiment around the equity market.

Chinese equities have long suffered as a consequence of this difficult economic backdrop, and rising concerns around geopolitics. So much so that in September, China lost its spot as the largest country weighting in MSCI Emerging Markets. Therefore at a time when interest in Chinese equities was at a trough, this stimulus package caused a significant, positive shift in sentiment, with Chinese equities seeing their best week of performance since 2008. In order for this rally to be sustained, we need to see the Government act on these pledges and on future pledges that they alluded to, and see that improve consumer confidence and flow through to corporate earnings.

This boost in Chinese equities led to Asian and wider Emerging Markets outperforming other regions, gaining 7.5% and 6.4% respectively.

September was another strong month for precious metals, with silver up 8% and gold up 5%. This was less surprising given the rate cuts we saw, particularly in the US, as environments of lower interest rates are usually more supportive for those metals.

US equities performed well on the back of rate cuts, with the technology heavy NASDAQ gaining 2.6% and the wider S&P500 not far behind with a 2% gain.

It was a less positive month for UK listed equities, given the Bank of England’s decision to hold rates steady, Sterling strength and some concerns from investors around changes that may be announced in the upcoming budget. This led to losses of -0.4% for the FTSE250, and -1.7% for the FTSE100.

Japanese equities also continued their run of being a more volatile area of developed markets, losing -3.1% over September. This market had sold off during the first half of the month as investors had expected to see the Bank of Japan raise rates, but then rallied through the second half following their decision to hold rates steady. As with the Yen, we then saw significant volatility in the last couple trading days of the month, as the market digested the news of the new Prime Minister and what that might mean for fiscal spending and interest rate policy.

Looking forward to the remainder of the year, investors are still heavily focussed on global growth and employment in the US, and what that might mean for the trajectory of interest rates. For now though, growth remains resilient and unemployment remains at low levels. We also now have the added injection of stimulus from China, which should help support their economy and in turn wider global growth.

We have over 1000 local advisers & staff specialising in investment advice all the way through to retirement planning. Provide some basic details through our quick and easy to use online tool, and we’ll provide you with the perfect match.

Alternatively, sign up to our newsletter to stay up to date with our latest news and expert insights.

| Match me to an adviser | Subscribe to receive updates |

The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. The views expressed in this publication represent those of the author and do not constitute financial advice.